How to make sure all contractors are properly insured, and why it matters.

Posted on September 11, 2021

Having insurance is required in Massachusetts by all contractors.

Contractors should hold two types of insurance:

General Liability insurance protects your property and belongings from damage by the contractor. A million-dollar limit in liability is the absolute minimum you should accept from a contractor and it’s not at all that expensive for the contractor to buy. Re-read that last line – a $1,000,000 policy sounds like it would be expensive, but it’s not.

Worker’s Compensation insurance protects the company’s workers who are working on your property.

If a worker is injured, their medical costs are covered by Worker’s Compensation. If a company does not carry Worker’s Compensation, you as the homeowner are likely liable for the injuries to the workers. Worker’s compensation insurance is fairly costly in Massachusetts. This is why many contractors try to get away with not buying it. BUT, understand, that not carrying Worker’s Compensation is illegal in Massachusetts.

Worker’s Comp policies are expensive because contractors use power equipment, climb ladders, and work near overhead wires, which can result in unintended but severe accidents and injuries.

How do I contact the contractor’s insurance company to ensure their insurance is in force?

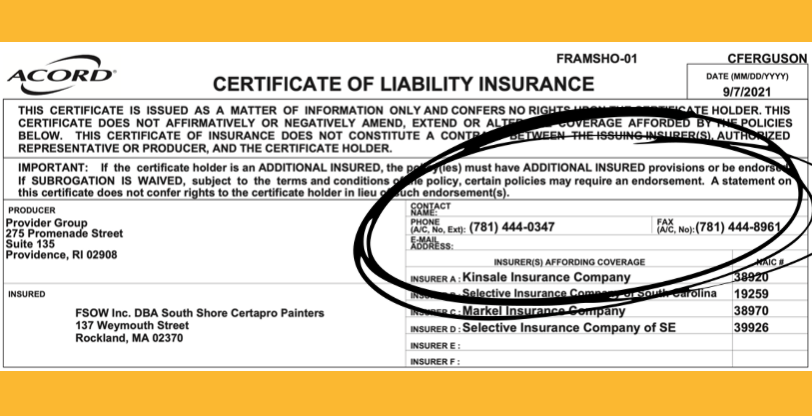

The insurance company’s contact information is provided in the upper right-hand corner of the certificate of insurance. Insurance companies are responsive – so if the company is not responding to your requests, it’s a red flag.

Ask for the contractor to submit their insurance when they submit their proposal.

Tricks contractors play with insurance:

A contractor may say, “We don’t need worker’s comp insurance in Massachusetts.”

This is a lie to eliminate a high-priced policy and pushes the burden of worker injuries on your property onto the homeowner.

Massachusetts is one of the strictest states and requires all contractors to protect their workers with Worker’s Compensation.

A contractor may tell you verbally that they are insured but are not.

To combat this, ask the insurance carrier to add you as “additional insured” to the policy and email you a copy. Make sure the insurance certificate is emailed directly from the insurance company.

It is very easy for an insured contractor to produce a Certificate of Insurance within a day. Most insurance agents can produce one within an hour, so if a contractor hems and haws about not being able to reach their agent to produce a certificate of insurance, this is a red flag that they may not be covered.

Contractors tamper with expired insurance certificates.

It’s super-easy to alter an insurance certificate with PhotoShop of even just plain-old white-out.

Contractors often fail to pay their monthly insurance premiums and may possess a Certificate of Insurance that shows an unexpired policy that’s been canceled due to non-payment.

By asking for the insurance certificate to be emailed to you directly from the insurance company, you can be sure it’s not an expired certificate that’s been tampered with to look up-to-date.

Some contractors try to pass off their auto or health insurance policies as business insurance.

What’s an umbrella policy?

When a contractor has an umbrella policy, it signals that this company cares about protecting its customers and employees for damages or expenses they incur beyond the limits of their regular insurance policies. The umbrella policy kicks in once the regular policy limits are used up.

Very few contractors carry umbrella coverage because it’s so expensive.

As a Massachusetts homeowner, you should never consider working with a contractor with neither Worker’s Comp and General Liability insurance in place. If you’re not sure about the validity of a contractor’s insurance, call the insurance carrier and confirm it is a current, unexpired policy.

You also might like to read:

CertaPro’s robust assortment of licenses and insurances

< BACK TO OUR INDEX OF ARTICLES, TIPS, AND ADVICE