CertaPro Painters Understand Inflation Affects Everyone

Posted on June 30, 2022

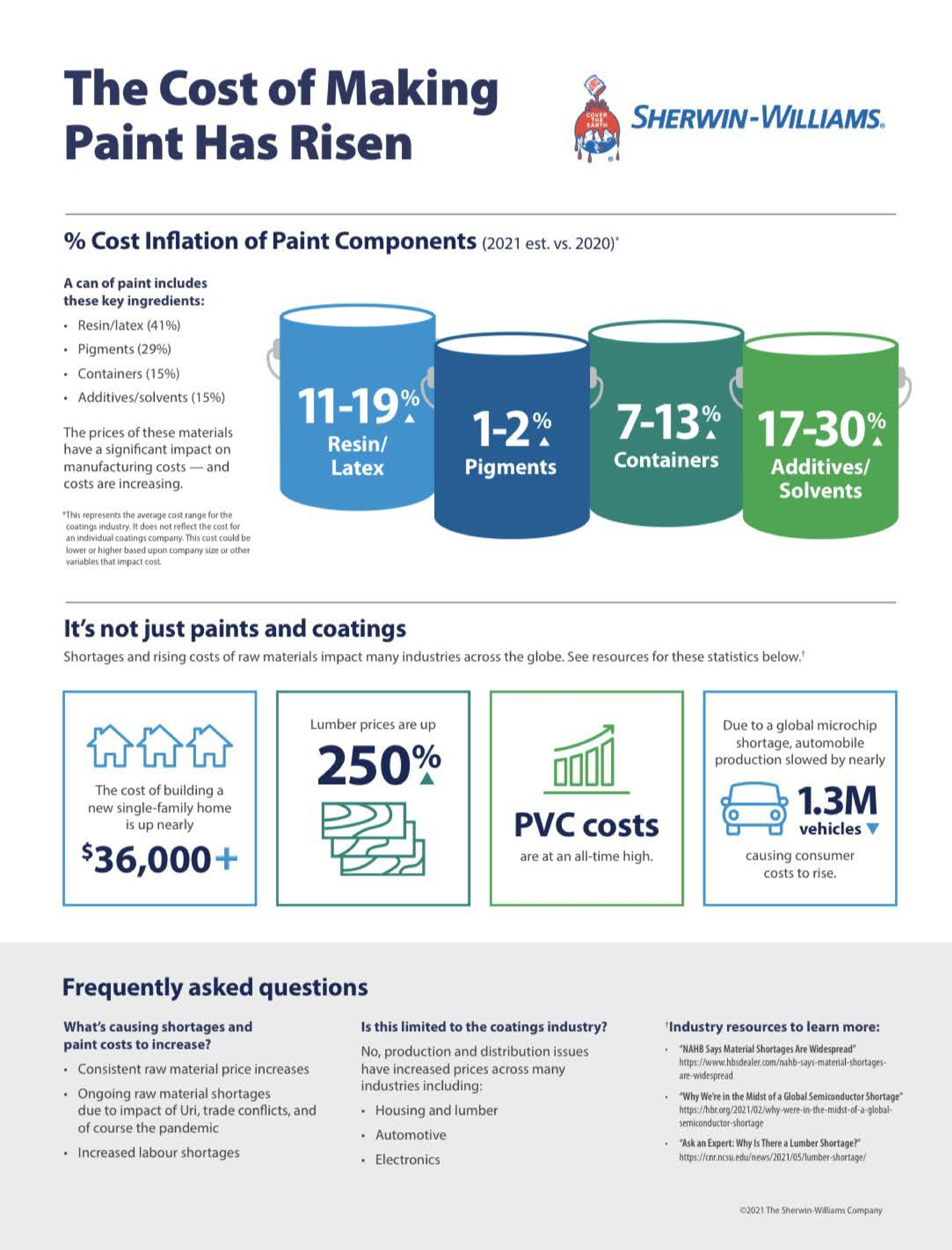

Rising prices & inflation are everywhere, from gas, to bacon to airfare. The home contracting services businesses are not immune from these inflationary pressures. Unfortunately, the materials we work with are subject to the same inflationary rising rates. At CertaPro Painters, we try our best to pass on every discount to our customers, but we also must raise prices when the cost of our materials increase.

Rising prices & inflation are everywhere, from gas, to bacon to airfare. The home contracting services businesses are not immune from these inflationary pressures. Unfortunately, the materials we work with are subject to the same inflationary rising rates. At CertaPro Painters, we try our best to pass on every discount to our customers, but we also must raise prices when the cost of our materials increase.

Consumer prices have been steadily increasing, but the last six months carry rates we have not seen since the 1980s. There is a contrast between desired inflation of 2% and the 8-month streak of higher rates.

When an economy grows, there is inflation. In general, inflation results when there is too much money in the system, leading to a higher price of goods in the marketplace. However, if a family’s two main sources of wealth-creation are rising at a rate equal to or greater than that of inflation, they can negate the effects of inflation.

Yet, as we’ve seen time and again, this usually is not the case. While the minimum wage has increased, the overall price of goods has outpaced the average salary increases of recent years.

Inflation is often referred to as the “worst tax” because its effects go unnoticed by most people. Hypothetically, earning 4% in a savings account while inflation grows at 7% makes many feel 4% richer. In fact, they are 3% poorer.

That’s why it’s important for households and investors alike to understand the causes and effects of inflation, and how to plan so as to ensure that their assets maintain their purchasing power.

Rising prices are everywhere, from gas, to bacon to airfare. The home contracting services businesses are not immune from these inflationary pressures. Unfortunately, the materials we work with are subject to the same inflationary rising rates.

At CertaPro Painters, we try our best to pass on every discount to our customers, but we also must raise prices when the cost of our materials increase. However, our professionalism, integrity and quality of our work will never be compromised. And we will always stand behind our work and materials.

Here are two tips to help you keep your home & business inflation-proof for years to come.

Invest in a Home

When done for the right reasons, like buying a home to live in, real estate is always a good investment. Problems occur when a buyer’s goal is to flip the property they just bought at a profit. Although experienced real estate agents are able to find hidden values in properties, the average person should focus on purchasing a home with the intent of holding on to it, even if only for a few years during these unstable times.

Real estate investments do not typically generate a return within several months or years; they require an extensive waiting period in order for values to increase.

As a home buyer, unless you’re paying cash, you’re likely to put some money down and take out a loan, known as a mortgage, for the remainder of the purchase price. There are different types of mortgages—fixed-rate and adjustable are the most common—but the underlying principle is the same.

You pay off a little of the principal each month until you’re left with ownership of a debt-free asset that should continue to appreciate over time.

If you get a fixed-rate mortgage, you end up paying off future debt with cheaper currency if rates increase. But if rates decrease, you’re still responsible for the fixed amount. Various factors should be taken into account in order to determine your best mortgage option.

Like land, home prices tend to increase in value on an average year-over-year basis. It is true that real estate bubbles are usually followed by correctional periods, sometimes causing homes to lose over half of their value.

Still, on average, housing prices tend to increase over time, counteracting the effects of inflation.

Invest in Yourself

By far the best investment you can make to be prepared for an uncertain financial future is an investment in yourself. One that will increase your future earning power.

This investment begins with quality education and continues with keeping skills up-to-date and learning new skills that will match those most needed in the not-too-distant future. Being able to stay on top of a business’s changing needs may not only help to inflation-proof your salary, but also recession-proof your career.

Conclusion

These are just a couple ideas to help you and your family fight the good fight against inflation. At CertaPro, we will always work with you to make all your dream projects come true. And you can always rely on our work and our authenticity when it comes to pricing our materials and labor.

Do you have a painting project you would like to begin? Call CertaPro Painters of Oswego at 331-725-6494 or go online to request an estimate today.